Saan aabot ang P1,000 mo?

Do you know that for as low ₱1,000, you can INVEST and GROW with the BIGGEST BRANDS in the country and around the world?

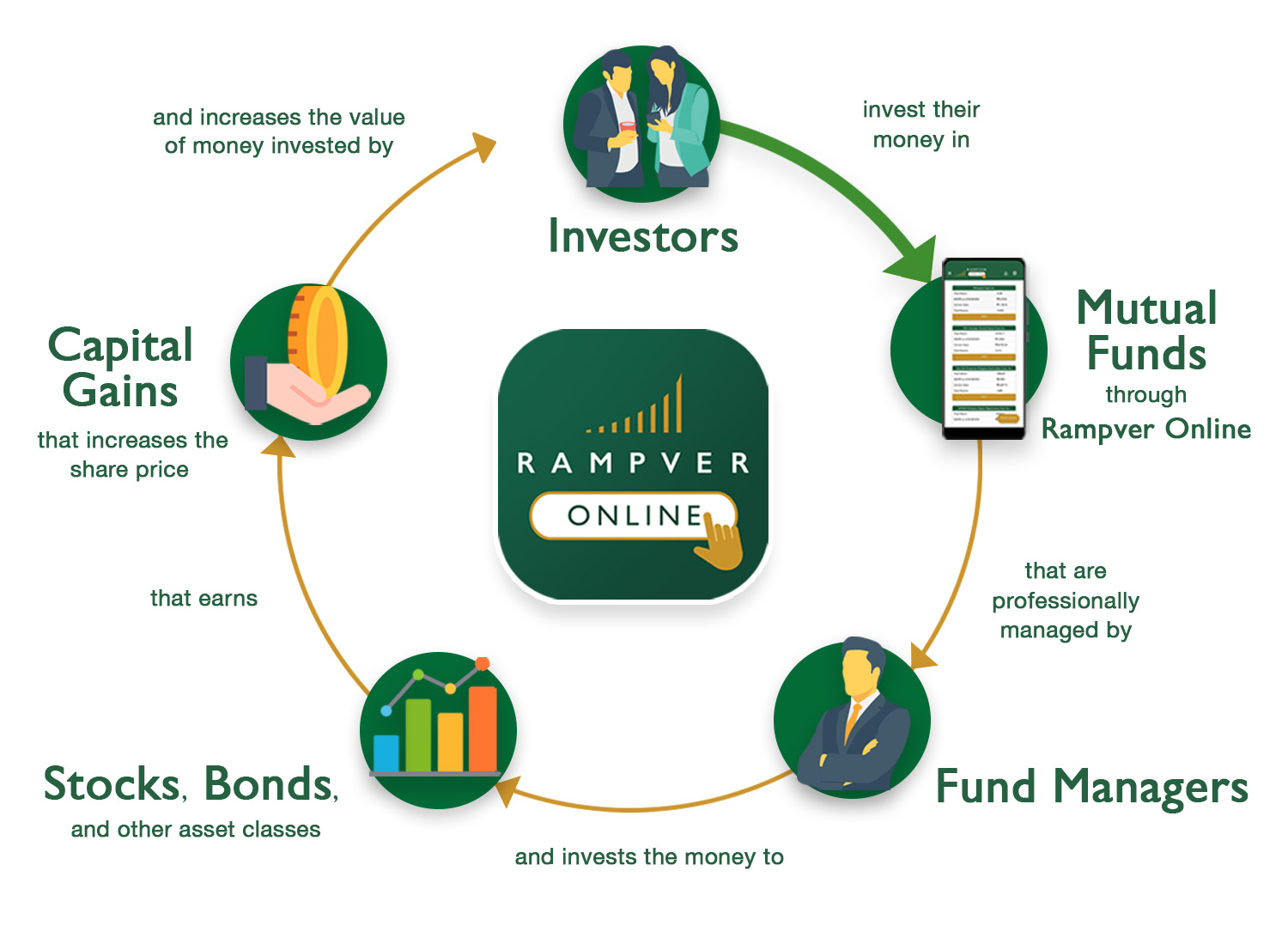

You too can enjoy the earnings potential of these big companies and brands. This is possible through investing in mutual funds.

Mutual funds are affordable, convenient, and beginner-friendly investment for Filipinos.