Your Guide to Mutual Funds

Everything You Need to Know

June 13, 2023 | by Erwin C. BaluyotFilipinos from all walks of life harbor dreams for themselves and their loved ones.

These dreams often include providing the best education for their children, owning a comfortable home, starting a successful business, and enjoying a secure retirement.

To turn these dreams into reality, Filipinos need to go beyond traditional savings accounts and embrace the world of investing.

Mutual funds offer a promising avenue for individuals who lack the time and expertise to actively manage their funds. In this blog post, we will explore the concept of mutual funds, how they work and the different types available in the Philippines.

What are Mutual Funds?

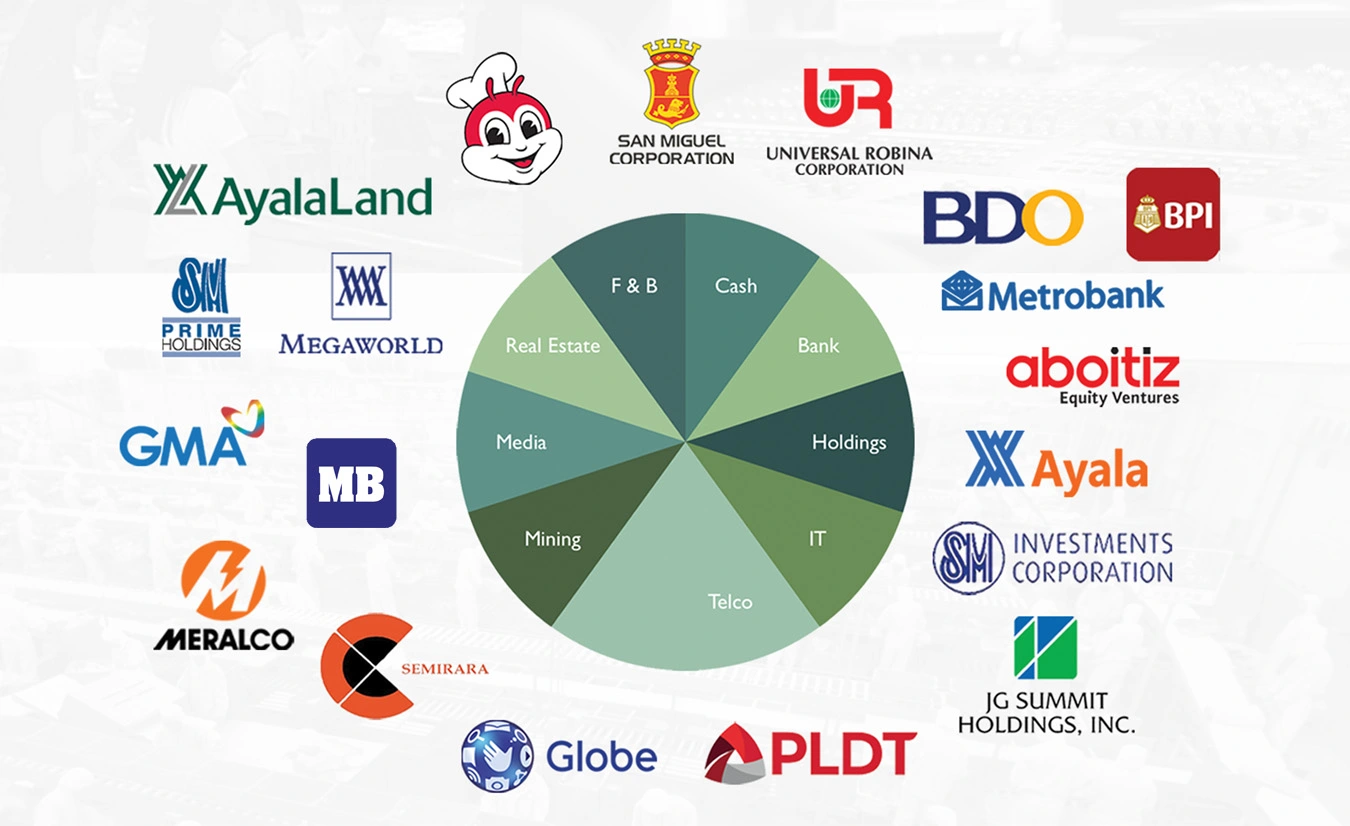

Mutual funds are investment companies that pool money from multiple investors to invest in a diverse range of assets, including stocks, bonds, and money market instruments.

These funds are professionally managed by experts known as fund managers, who aim to generate capital gains or income for the investors.

How Do Mutual Funds Work?

When individuals invest in mutual funds, their money is combined with funds from other investors.

The pooled money is then used by the fund manager to invest in various assets. Investors hold shares in the mutual fund and benefit from the gains or losses of the overall fund. Profits earned by the fund can be distributed to investors as dividends or reinvested to purchase additional assets, potentially increasing the value of their investment.

Understanding Net Asset Value per Share/Units (NAVPS/NAVPU)

The price of each share in a mutual fund is determined by its Net Asset Value per Share (NAVPS) or Units (NAVPU).

The NAVPS/NAVPU reflects the value of the fund's underlying securities and changes daily based on market performance.

Investors participate proportionally in the gains or losses of the fund, as the NAVPS/NAVPU fluctuates with the valuation of the securities held by the fund.

The fund's NAVPS/NAVPU is published daily every banking day, allowing investors to monitor their investment's performance.

Earning Money from Mutual Funds

Investors can earn money from mutual funds through three primary avenues: dividends and capital appreciation

Dividends are earned from stocks or interest on assets, which the mutual fund company pays to investors.

Capital gains are generated when the fund sells securities at a higher value, and these gains are distributed to investors.

Types of Mutual Funds in the Philippines:

Stock Funds/Equity Funds

These funds invest in a diversified portfolio of stocks of listed companies and have the potential for higher long-term returns.

They are suitable for investors with long-term financial goals, such as education funds, retirement planning, and future business ventures.

The recommended length of stay is five years and beyond.

Examples:

Bond Funds

Bond funds invest in a diversified portfolio of fixed-income instruments, such as government securities and treasury bills.

They earn income through regular interest payments and can serve as a conservative investment option for those seeking to protect their funds against market volatility.

The recommended time horizon for this type of fund is one to three years.

Examples:Balanced Funds

Balanced funds combine stocks, bonds, and money market instruments in a single portfolio. They aim to achieve moderate returns while managing risk.

These funds are suitable for investors with a moderate risk appetite and a time horizon of three to five years.

Examples:- ATRAM Philippine Balanced Fund

- Sun Life of Canada Prosperity Balanced Fund

- ATRAM Unicapital Diversified Growth Fund

Money Market Funds

Money market funds invest in short-term debt securities, offering the lowest risk among all fund types. While they generate modest returns, they provide stability and liquidity. These funds are ideal for investors with a low-risk tolerance and a short-term investment horizon.

This fund is suitable for investors with low risk tolerance and short-term investment horizon, usually less than one year.

Recommended for investors who may need their fund in a short period of time yet seek safer and more stable investment vehicles and still earn better than traditional bank products.

Examples:

Seek Financial Advice First

Before investing in mutual funds, it is crucial to seek financial advice that aligns with your financial objectives, time horizon, and risk appetite.

Factors such as the fund's track record, the expertise of the fund manager, and accessibility should be considered. Proper goal setting and a thorough understanding of the chosen fund are essential for a successful long-term commitment.

Conclusion

Mutual funds offer Filipinos an opportunity to achieve their dreams by expanding their financial horizons beyond traditional savings accounts.

With professional management and diversified investment strategies, mutual funds can provide attractive returns and help individuals navigate the complexities of the financial markets.

By selecting the right fund that aligns with their goals, time horizon, and risk tolerance, Filipinos can embark on a path to secure their financial future and fulfill their life's dreams.

Start your investment journey today!

If you want to start your own investment journey, Rampver Financials is here to help!

Rampver Financials is a complete one-stop shop for the best financial products & services in the Philippines!

We help you make your important financial decisions simple & easy.

By listening to your needs & goals, we match you with the best products & services, and guide you throughout your journey so that you can be confident that your financial needs are covered. You can enjoy the convenience of talking to one financial advisor who is knowledgeable, has access and can service you for all your investment and insurance needs (no matter what company or brand it is)!

Kindly click the "Inquire now" button on top of this page, fill out the form, and a dedicated Rampver representative shall get in touch with you shortly. Thank you!