Become a shareholder of the best companies in the Philippines!

Investing in the stock market is made easy nowadays with the presence of online stock brokerages. This enables users to buy and sell shares of local companies of their choice through a digital platform. These digital platforms provide convenience and a seamless experience to users who are interested in jumpstarting their stock market journey.

Benefits of Direct Stock Investing

Create your own Stock Portfolio

Hand-pick companies that will make up the entirety of your stock portfolio

Execute Buy and Sell Orders

Easily place buy and sell orders at any trading day during trading hours

Monitor your Investments in Real-time

Track the status of your investments real time with a mobile app

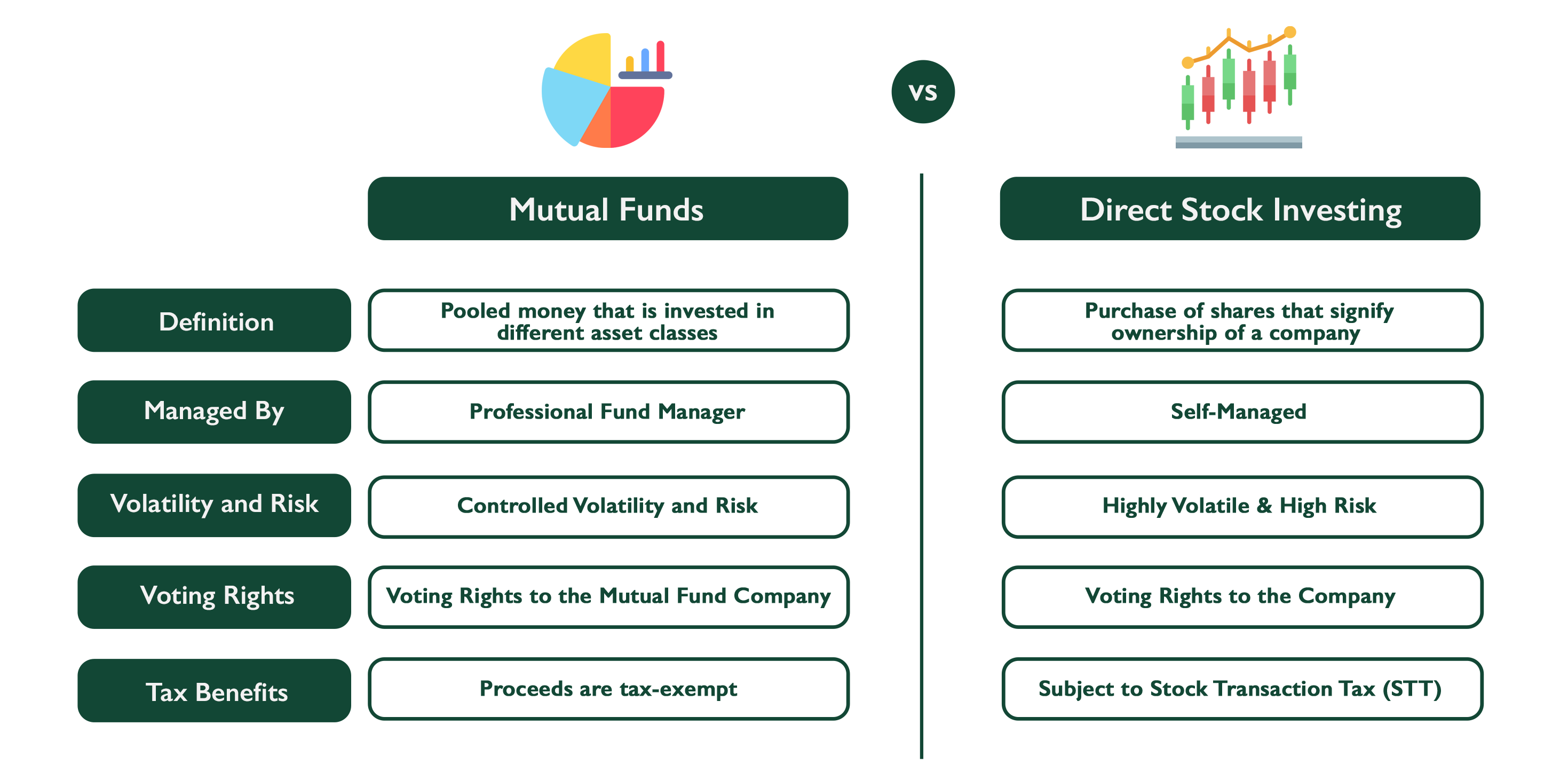

Mutual Funds versus Direct Stock Investing

Frequently Asked Questions

Direct stock investing is “directly” purchasing and selling listed shares of a company through a licensed stockbroker.

The main difference between mutual funds and direct stock investing is that mutual funds are pooled money from multiple investors and are managed by a professional fund manager, thus providing a well-diversified portfolio.

As for direct stock investing, the account holder has the freedom to choose when to buy and sell shares of his or her preferred stock. This allows the account holder to have full control of his or her investment portfolio but requires more research. Direct stock investing also carries higher risk if the individual has no basic knowledge about investing and has no proper risk management.

Direct stock investing is for clients who want to manage their own portfolios and be in control of which specific stocks they want to be invested in. Compared to managed funds, the client becomes the full-time manager for his or her portfolio responsible for executing buy and sell orders.

Deciding on which online stock broker to choose from will heavily depend on your needs and preferences on the type of services being offered by different platforms. To know more about online stock brokers, kindly contact us at [email protected] and one of our account officers will get in touch within 1-2 business days.

The minimum initial deposit to activate an account for both MyTrade and UTrade stock trading platforms is only P10,000. Feel free to contact your account officer to know more about existing promotions you can avail of. If you wish to add more funds in your stock trading account, the minimum deposit is P1,000.

Got more questions?