Invest in your health and secure your wealth with a healthcare plan!

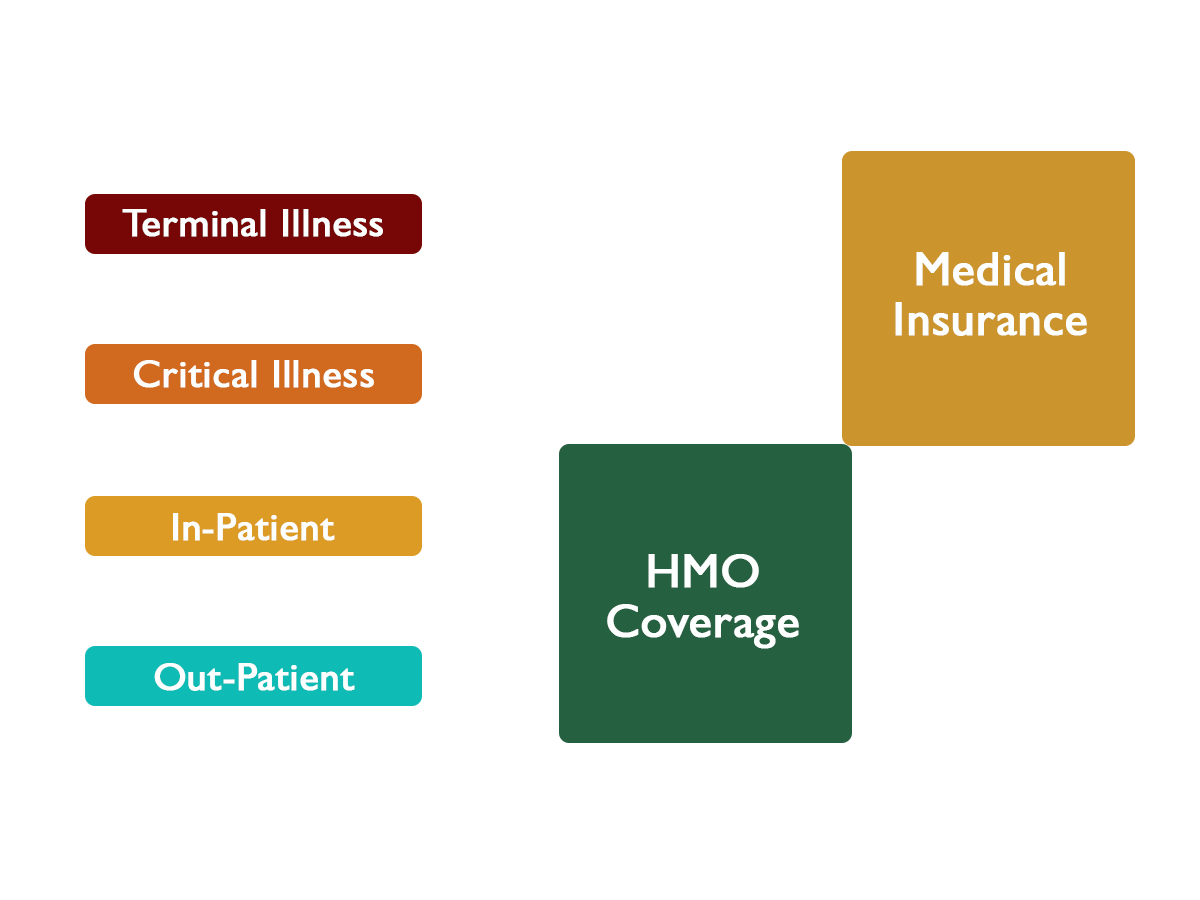

Getting sick is not easy nowadays due to rising prices of medicines and expensive hospital bills. A healthcare plan is what you need to save you from bankruptcy caused by medical challenges. A comprehensive healthcare plan consists of an HMO and a Medical Insurance that is customized based on your personal needs and preference. This aims to protect you from any medical expense you may incur at any given time.

Benefits of Having a Healthcare Plan

Access any Medical and Clinical Facility

Address your healthcare needs anytime and anywhere

Worry-free Medical Expenses

Rest and recover from any medical challenge with no financial burdens

Secure your family’s health and future

Keep track of each family member’s health condition anytime

Importance of a Healthcare Portfolio

Having a combination of an HMO plan and a medical insurance policy will give you a complete, all-inclusive healthcare portfolio. This ensures that you are covered for emergencies, hospitalization, physical and diagnostic exams, consultations plus other benefits.

Frequently Asked Questions

A Health Maintenance Organization plan (HMO) is a membership plan that gives you access to a wide network of doctors, clinics, specialists and hospitals for your healthcare needs.

Having an HMO plan, you can access any medical facility anywhere that falls under the plan you availed off. You can also have yourself checked anytime and consult a doctor, undergo laboratory tests and more. To know more about our HMO plans, kindly fill out this form or contact us at info@rampver.com. An account officer will reach out to you through email within 1-2 business days.

A medical insurance is a type of insurance that covers the costs of an insured individual’s medical and surgical expenses such as doctor’s fee, operating room, prescribed medicines, and more.

As a person ages, the chances of having an illness increases which unfortunately is very costly. Medical and surgical costs are very expensive these days. That’s why medical insurance has been created as a solution to help people be able to pay off these expenses without exhausting their savings accounts by offering coverage plans for medical, surgical and medications costs.

Medical insurance and HMO plans are two different types of health insurance coverage. A Health Maintenance Organization (HMO) is a managed care plan that provides a specific network of doctors, hospitals, and other medical providers for its members to choose from. The coverage provided by HMO plans is generally focused on in-patient benefits, and the client's access to healthcare is limited to the providers within the HMO network. The average coverage of an HMO plan ranges from Php 50k-300k.

On the other hand, medical insurance, also known as fee-for-service insurance, allows the client to choose their healthcare providers and hospitals. The coverage provided by medical insurance typically includes in-patient, out-patient, emergency, and preventive care benefits. The average coverage of a medical insurance plan is higher, ranging from Php 500k and above.

A healthcare plan is a type of insurance that helps individuals and families pay for all kinds of medical expenses. It typically covers services such as medical consultations, medical emergencies, hospital stays, surgeries, prescription medications, laboratory tests & diagnostics and other health-related treatments. The terms and coverage of the plan vary depending on the type of plan, the insurer, and the needs of the individual or group.

Healthcare plans are designed to help individuals manage the cost of medical care and access necessary health services. It is very important to have a healthcare plan these days due to rising medical costs nowadays and it is also important to have a healthcare plan that is customized based on your needs and lifestyle to really get the best value out of it. To know more about our comprehensive healthcare plans, please send us an email at info@rampver.com

Yes you still can avail of a healthcare plan depending on the kind of pre-existing condition you currently have. Unfortunately, there will be limitations when you avail a healthcare plan such as a lower HMO coverage and a higher medical insurance premium.

Got more questions?